Mark Fenton – SPX All Put Flat Fly Class

$249.00 Original price was: $249.00.$52.00Current price is: $52.00.

Access Method: After completing your purchase, simply download the digital content and start learning on your computer, tablet, or smartphone — wherever and whenever you like.

Learn Mark Fenton’s SPX All Put Flat Fly Class and master advanced SPX butterfly trading, strike selection, adjustments, and controlled-risk income strategies. Download the complete training today.

Mark Fenton – SPX All Put Flat Fly Class

📄 Original content sourced from the official sales page.

Click the link to view the original course description, features, and official curriculum directly from the creator.

Product Overview provided by YourLun:

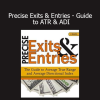

Proof Content

Mark Fenton – SPX All Put Flat Fly Class: Master Precision Options Structures, Controlled Risk & High-Confidence SPX Income Trading

Trading the S&P 500 (SPX) requires a blend of market intuition, calculated risk management, and a deep understanding of option structures that perform reliably across shifting volatility environments.

In Mark Fenton’s SPX All Put Flat Fly Class, you’ll learn how to structure, adjust, and manage one of the most versatile and capital-efficient strategies available to SPX traders: the all-put flat butterfly.

This program goes far beyond simple entry rules or generic fly setups.

Mark teaches you how to leverage skew behavior, time decay characteristics, strike spacing logic, and volatility transitions to build trades that remain stable—even when market conditions feel uncertain or erratic.

Whether you’re looking to refine your income trading, add a non-directional strategy to your toolkit, or deepen your understanding of SPX mechanics, this class provides the clarity, structure, and repeatability advanced traders rely on.

What You’ll Learn Inside This Advanced Options Training

Every module is engineered to help traders understand not just how the trade works, but why it works—and how to optimize it under real market pressures.

Core Concepts & High-Level Skills You Will Develop

Understanding the All-Put Flat Fly Structure

Explore what makes the flat fly distinctive, how to choose optimal wings, and why the strategy responds well to SPX pricing dynamics.

Entry Logic, Strike Selection & Market Context

Learn how to select strikes based on market posture, volatility levels, skew positioning, and expected price distribution.

Managing Greeks With Precision

Gain mastery over delta, theta, vega, and skew behavior as they apply specifically to SPX put structures.

Adjustment Techniques for Stability & Consistency

Develop a clear framework for when and how to adjust—rolling, widening, shifting, or converting—based on risk parameters and market movement.

Expiration Week Tactics

Discover how to harvest theta effectively, navigate intraday SPX movement, and manage the unique volatility patterns of SPX near expiration.

Trade Psychology & Risk Discipline

Strengthen consistency by applying rules that protect capital, reduce emotional decision-making, and maintain a data-driven approach.

This isn’t about prediction—it’s about positioning.

You’ll walk away with a structured, reliable process for trading SPX using one of the most durable spreads in the options world.

Who This Course Is Ideal For

-

Options traders seeking a rules-based, income-oriented SPX strategy

-

Advanced and intermediate traders wanting deeper butterfly mastery

-

Traders who prefer defined-risk, non-directional setups

-

Anyone wanting to improve consistency in volatile SPX environments

About Mark Fenton

A widely respected options educator and seasoned trader, Mark Fenton is known for translating complex market concepts into clear, actionable systems.

His teaching blends experience, market realism, and logical structure—making advanced strategies approachable without oversimplifying their mechanics.

Mark’s flat fly methodology has become a core technique for traders seeking steady returns with controlled risk.

Why This SPX Strategy Class Stands Out

📊 Teaches a sophisticated structure with clear execution steps

⚖️ Defined-risk strategy suitable for income and stability

📈 Adaptable in both low and high volatility regimes

🧠 Focuses on logic, rules, and repeatability

💼 Perfect for traders building a reliable options income plan

Trade SPX With Precision, Structure & Confidence

If you’re ready to upgrade your SPX trading skills and learn a stable, intentional approach to option income, Mark Fenton’s SPX All Put Flat Fly Class delivers the framework you need.

With Mark’s guidance, you’ll master a strategy that brings clarity to chaotic markets and consistency to your trading routine.

Be the first to review “Mark Fenton – SPX All Put Flat Fly Class” Cancel reply

Related products

Financial Markets

Financial Markets

Financial Trading

Financial Trading

Anton Kreil – Course 3 – Professional Options Trading Masterclass (POTM) Video Series

Financial Trading

Financial Trading

Financial Trading

Randy Perez – Option Trading for Financial Freedom (Intermediate Option Trading Course)

Financial Markets

Reviews

There are no reviews yet.